colorado springs sales tax rate 2019

Governor Polis signed HB22-1027 on January 31 2022 which extends the small business exception to destination sourcing requirements. What is the sales tax rate in Colorado Springs Colorado.

The arguments in favor of the measure as provided in the Colorado Springs November 2019 election notice are.

. City of Colorado Springs Sales Tax Contact Information. Any sale made in Colorado may also be subject to state-administered local sales taxes. 719 385-5291 Email Sales Tax Email Construction Sales Tax.

Restaurant must charge city tax at the discounted rate for the. Thats why the City Council voted unanimously to refer a. Colorado Springs voters approved a five-year extension of the 2C sales tax at.

187 lower than the maximum sales tax in CO. Intended to be substituted for the full text within the City of Colorado Springs Tax Code. Amended returns must be filed by mail.

You can print a. The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax. This web page contains changes to existing sales or use tax rates.

The current total local sales tax rate in Colorado Springs CO is 8200. The December 2020 total local sales tax rate was 8250. If you owe additional tax return the completed form and.

719-385-5291 Investigator Line. Colorado state sales tax is imposed at a rate of 29. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is.

Colorado Springs CO 80903. The latest sales tax rates for cities in Colorado CO state. On January 1 2019 numerous local sales and.

Calendar year Discounted rate Regular rate. The reduced rate is a result of a lower 2C tax rate of 057 percent down from 062 percent. 2020 rates included for use while preparing your income tax deduction.

Rates include state county and city taxes. The 903 sales tax rate in Manitou Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 39 Manitou. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744.

The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123. The Colorado Department of Revenue collects sales and use tax for some jurisdictions in the. This exception applies only to.

On January 1 2019 numerous local sales and use tax rate changes took effect in Colorado. Groceries and prescription drugs are exempt from the Colorado sales tax. Tax Rate 312 effective January 1 2016 December 31 2020.

To find all applicable sales or use tax rates. Review Colorado state city and county sales tax changes. City of Colorado Springs Sales and Use tax.

This is the total of state county and city sales. This page does not contain all tax rates for a business location. Colorado sales tax rate change and sales tax rule tracker.

This form is found below.

Filing Colorado State Tax Returns Things To Know Credit Karma

Colorado Sales Tax Calculator And Local Rates 2021 Wise

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Sales New Construction Fall As Colorado Springs Housing Market Cools Off Subscriber Content Gazette Com

Colorado Springs Colorado Co Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Colorado Sales Tax Rates By City County 2022

Denver Ballot Measure 2a 2b Results Voters Approve Taxes For Homeless Environment

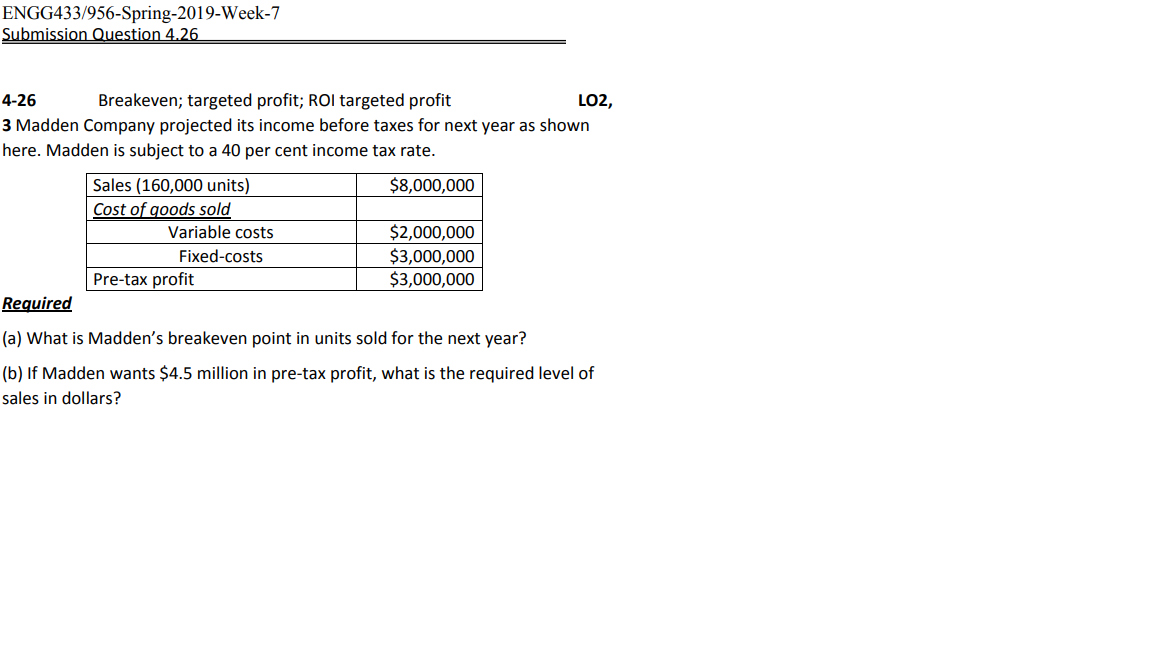

Solved A What Is Madden S Breakeven Point In Units Sold For Chegg Com

Are Vacation Rentals A Good Investment Springs Homes

2021 Colorado Springs Real Estate Investing Guide Denver Investment Real Estate

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Colorado Springs Colorado Co Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

U S Cities With The Highest Property Taxes

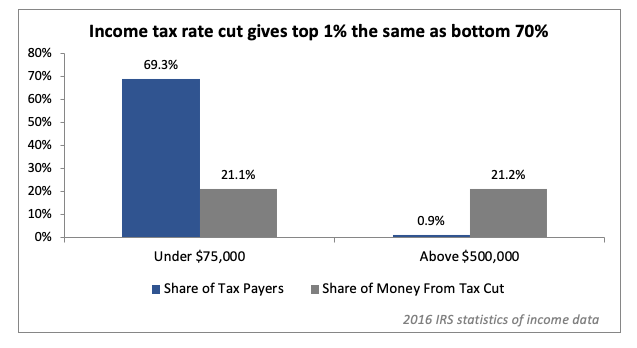

Income Tax Rate Reduction Benefits Highest Income Coloradans Most Colorado Fiscal Institute

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Colorado Proposition 116 Decrease Income Tax Rate From 4 63 To 4 55 Initiative 2020 Ballotpedia